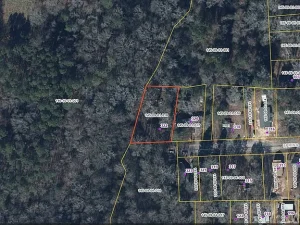

Residential Brick Home

IMPORTANT NOTICE: The price listed in the advertisement is for listing purposes only. It is NOT the purchase price. This property is being offered through an online-only auction, and the final sales price will be determined by competitive bidding. The opening bid for properties in this auction is $100, and the property will be sold to the highest bidder in accordance with auction terms and conditions.

This residential brick home represents one of 11 properties being offered in the same online auction event. Opportunities like this are often attractive to experienced investors, cash buyers, and individuals familiar with auction purchases and tax sale properties.

Auction Structure & Terms

This is an online-only auction, meaning all bidding activity will take place digitally through the designated auction platform. Interested buyers must:

Register to bid

Review all auction terms and conditions

Conduct independent due diligence

Place bids within the specified auction timeframe

The property will be awarded to the highest qualified bidder at the conclusion of the auction.

Again, the price displayed in the listing is not the purchase price. It is used strictly for marketing and platform purposes.

Property Overview

The property is a residential brick home, offering traditional construction and structural durability commonly associated with brick exteriors. Brick homes are often valued for:

Longevity

Low exterior maintenance

Classic curb appeal

Resistance to weather elements

While detailed interior specifications may not be available, the structure itself presents potential for renovation, rental, resale, or long-term hold, depending on the buyer’s strategy.

Acquisition Background

The seller acquired this property through a delinquent tax sale deed. As a result:

The property will be transferred via Quitclaim Deed only.

The transfer will use the most recent deed description available.

No title search has been conducted by the seller.

No title search has been conducted by the auctioneer.

No title search has been conducted by the closing attorney.

Title insurance will not be offered.

This is a critical aspect of the sale and must be carefully understood by all prospective bidders.

Quitclaim Deed Explained

A Quitclaim Deed transfers whatever ownership interest the seller may have in the property at the time of conveyance. It does not guarantee:

Clear title

Absence of liens

Absence of encumbrances

Marketable title

Buyers assume responsibility for understanding the implications of purchasing via quitclaim deed.

This type of transfer is common in tax deed and distressed property auctions and is generally best suited for experienced investors who understand title risk and redemption considerations.

Due Diligence Responsibility

It is the bidder’s responsibility to conduct all necessary due diligence prior to placing a bid. This includes, but is not limited to:

Reviewing public records

Verifying ownership history

Investigating outstanding liens

Confirming tax status

Checking for municipal code violations

Reviewing zoning regulations

Inspecting the physical condition of the property

The seller, auctioneer, and closing attorney make no warranties or representations regarding the property’s condition or title status.

Property Inspection

Prospective bidders are strongly encouraged to:

Visit the property in person

Inspect the exterior

Verify access

Evaluate neighborhood conditions

Assess renovation needs

Because the property is being sold through auction and transferred via quitclaim deed, buyers should assume the property is sold as-is, where-is, with all faults, known or unknown.

No guarantees are made regarding:

Structural integrity

Utility functionality

Occupancy status

Code compliance

Independent evaluation is essential.

Investment Potential

Properties sold via online auction often appeal to:

Real estate investors

Rehab specialists

Buy-and-hold landlords

Value-driven buyers

Contractors seeking project homes

A brick residential structure can offer:

Solid renovation foundation

Rental income potential

Long-term appreciation opportunity

Fix-and-flip possibilities

However, buyers must account for potential legal and title complexities in their investment calculations.

Risk Considerations

Purchasing a tax deed property via quitclaim deed carries inherent risks, including:

Clouded title

Redemption rights (if applicable under local law)

Unknown liens or encumbrances

Additional legal expenses

Extended holding time for title clarification

Because no title insurance will be offered, bidders should factor potential legal costs into their bidding strategy.

Why Auctions Attract Investors

Online real estate auctions create competitive environments where properties can:

Sell below market value

Provide access to distressed assets

Offer portfolio expansion opportunities

Allow entry at lower price points

The $100 opening bid is simply the starting point for bidding and does not reflect market value.

Important Reminders

The listed price is NOT the purchase price.

Opening bid is $100.

Final sale price determined by highest bidder.

Property sold via Quitclaim Deed only.

No title search performed.

No title insurance provided.

Buyer responsible for all due diligence.

Strongly recommended to inspect property prior to bidding.

Ideal Buyer Profile

This opportunity is most appropriate for:

Experienced investors

Cash buyers

Individuals familiar with tax sale properties

Buyers comfortable with title risk

Buyers prepared for potential legal research

It may not be suitable for first-time homebuyers or individuals seeking traditional financing.

Strategic Approach for Bidders

Before bidding, consider:

Reviewing county property records.

Checking for outstanding taxes or liens.

Consulting a real estate attorney if needed.

Evaluating renovation costs.

Setting a maximum bid aligned with risk tolerance.

Bidding without research increases exposure to unforeseen costs.

Final Thoughts

This residential brick home presents an auction-based opportunity within a portfolio of 11 properties being sold online. With a starting bid of $100 and competitive bidding determining final price, the property offers potential for value-driven acquisition.

However, it is essential to understand:

The transfer is via Quitclaim Deed only.

No title search has been conducted.

No title insurance will be provided.

All due diligence is the responsibility of the bidder.

For informed investors who understand auction dynamics and tax deed acquisitions, this may represent a strategic opportunity to acquire property through competitive bidding.

Interested parties should carefully review auction details, conduct thorough research, inspect the property where possible, and prepare accordingly before participating.

Opportunities in online auctions reward preparation and discipline. If you are ready to perform the necessary due diligence and compete strategically, this property could be part of your next investment move.

Listed on Zillow